What is TTD and am I entitled to it?

All Indiana employees need to know the worker’s comp basics if they’ve been injured on the job. One essential term is Temporary Total Disability (TTD). In Indiana, TTD is money paid to injured employees whose work-related injury results in either total off-work orders by the treating worker’s compensation doctor, or work restrictions that the employer is unable to accommodate. In other words, it is designed to replace wages lost due to a work injury. The value of TTD benefits owed is set by Indiana Worker’s Compensation Law. It’s two-thirds (2/3) of the injured employee’s average weekly wage (AWW). AWW is typically calculated by looking back at a year’s worth of wages, and taking the average.

Not Every Injured Worker is Entitled to TTD

Not every injured worker is entitled to temporary total disability (TTD). For instance, if your injury isn’t serious enough to require work restrictions or to take you off work, you’ll continue to earn your ordinary wage. Likewise, if you’re placed on work restrictions but your employer offers work within the restrictions, you’re not entitled to TTD (though you may be entitled to something called Temporary Partial Disability (TPD) if you have to work fewer hours).

If your employer or its worker’s comp insurance company deny your claim (for instance if they claim your injury wasn’t work related), they will refuse to pay TTD. If you disagree with the denial, you have the right to file your claim with the Indiana Worker’s Comp Board. However, with what is at stake, you should consider hiring a skilled worker’s compensation attorney like Charles Hewins of Salmon & Hewins.

Temporary Total Disability Benefits Don’t Last Forever

As the term itself suggests, temporary total disability (TTD) is not designed to last forever. It usually takes a few weeks to a few months for an injured Indiana worker to recover from an injury. When the worker reaches that point, the doctor will release him or her at Maximum Medical Improvement (MMI). Once a doctor says you, the injured employee, are at MMI, the worker’s comp insurance company is allowed to stop paying TTD to you.

Imagine a situation where you’re off work receiving TTD because your employer can’t accommodate your restriction of “no lifting over 5 pounds.” Now, suppose the doctor changes your restrictions to “no lifting over 40 pounds.” Your employer may have a job opening that meets those restrictions. In that case, if the employer offers you a job within your restrictions, it no longer has to pay TTD. This applies whether you take the job or not! So, the lesson here is – if your employer offers work within restrictions, don’t refuse it and think you’ll continue to receive TTD. If you think the restrictions shouldn’t have been eased, I frequently advise my clients to at least try to work under the new restrictions. That way, if they tell the employer they can’t do it and go home, they will at least be able to tell the worker’s comp judge they tried and couldn’t do the work.

There are other reasons why an employer may be entitled to stop paying TTD once begun. Those include:

- The doctor places you at maximum medical improvement (MMI);

- Your restrictions change and the employer offers work within those restrictions;

- You refuse or fail to attend your doctor’s appointments or physical therapy sessions;

- You refuse or fail to attend an appointment with a “second opinion” doctor;

- Your become unable or unable to work for reasons unrelated to your work injury; and

- You have reached the maximum number of allowable weeks (500 weeks).

Watch Out for the Seven Day Waiting Period

Employers get a sort of “free pass” when it comes to temporary total disability (TTD) for minor injuries. The Indiana Worker’s Compensation Act states that the worker’s comp company does not have to pay TTD for the first seven days an employee is off work unless he or she ends up missing at least 21 days in total. If the employee hits 21 days, worker’s comp must then go back and pay for the first seven days. In rare situations, unscrupulous worker’s comp companies may fail to go back and pay the first seven days. That is why I always advise my clients to keep ALL TTD check stubs from worker’s comp to be sure they have been paid the proper rate for each and every date owed. If you’ve got an active worker’s comp case and discover that worker’s comp insurance hasn’t paid you what you’re owed in TTD, call Charles Hewins of Salmon & Hewins to discuss. The initial consultation is always free.

How Much Money Will You Receive in TTD Benefits?

The value of TTD benefits owed is two-thirds (⅔) of the injured employee’s average weekly wage (AWW). AWW is typically calculated by looking back at a year’s worth of wages, and taking the average. If you work only one job, have been there at least a year, and are compensated only by salary or hourly wage (meaning you receive no bonuses, commissions, tips, or other additional compensation), this is fairly straightforward. Wages for each of the last 52 weeks are added up, then divided by 52. This is your AWW, which is then multiplied by two-thirds (⅔) to determine your TTD. If you have been at your job less than 52 weeks, the AWW of the time you have been there may be used. If you have been at your job a very short time, information from other employees doing similar work may be used.

Calculation of AWW becomes more complicated for workers receiving tips, bonuses, commissions, and other compensation in addition to their salary or hourly wage. These earnings should absolutely be taken into consideration when determining AWW, but some employers fail to do so.

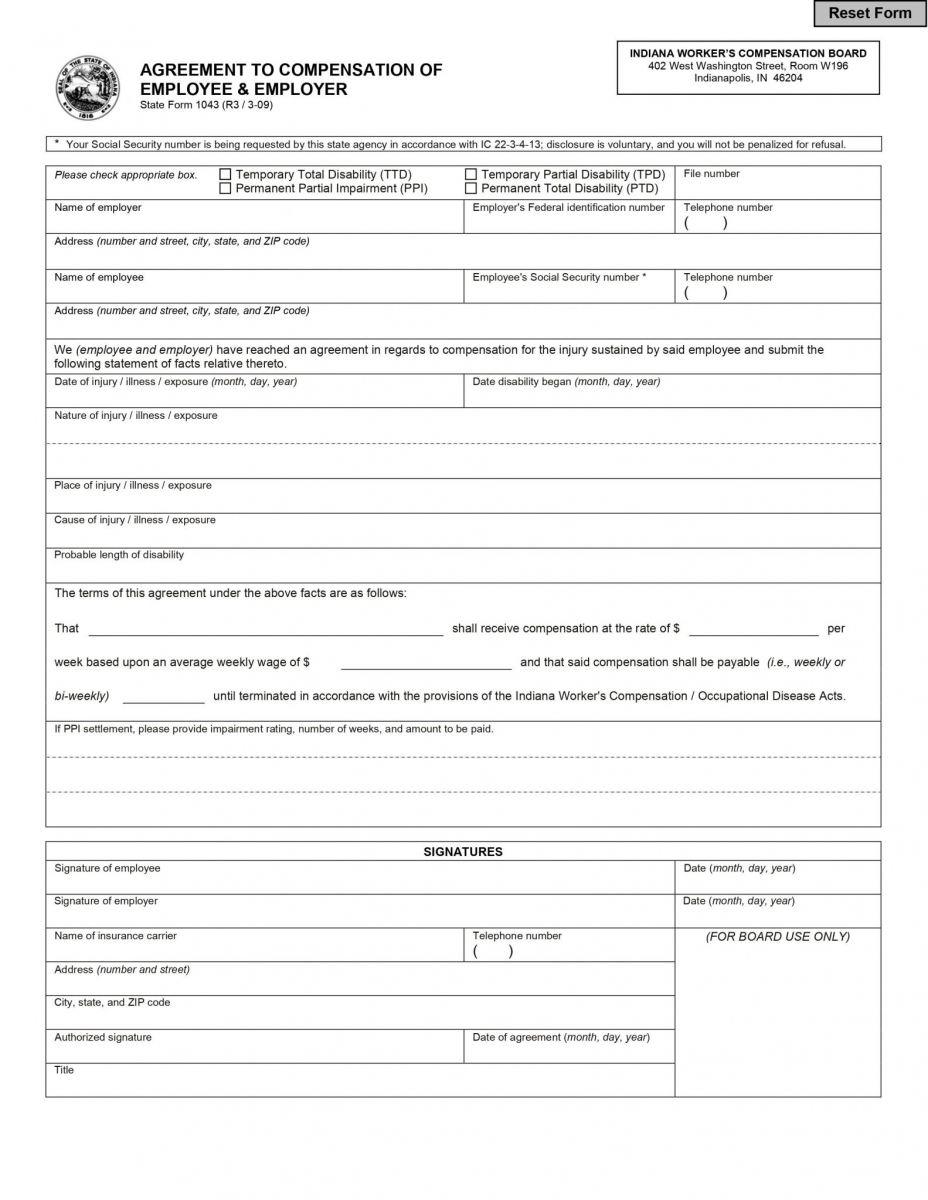

What can you, as an injured Indiana worker, do to insure you are receiving the full amount of TTD you are entitled to? When your employer offers you TTD benefits, they will use a form showing the benefits they are offering you. Review this form carefully. If you don’t agree with the calculations or aren’t sure whether your employer has included all of your income, you presently do not have to sign the form. Your employer will still have to pay you TTD benefits whether or not you sign the form, and not signing will allow you to challenge the amount later if you do more research or hire an attorney. If you sign the form without verifying your AWW is properly calculated, you may be permanently consenting to your employer’s calculations of TTD benefits owed to you.

How Can Your Attorney Help With TTD?

In another blog post, I’ll dig into the details about how temporary total disability (TTD) is supposed to be calculated. To put it briefly, it’s pretty simple if you have one job and earn one paycheck a week. But if you have multiple jobs, receive bonuses or other compensation, or haven’t worked for a full year prior to the date of injury, the worker’s comp insurance company may mess up your TTD rate and under-pay your benefits. Your employer’s work comp company may send you an Agreement to Compensation (picture below) and tell you that it must be signed and returned before TTD is paid. This is FALSE. In fact, unless you are absolutely sure that the calculations on the form are correct regarding your wages, I advise my clients not to sign until wages can be verified. At Salmon & Hewins, we seek out wage records (not summaries) for our clients to verify the worker’s comp insurance company’s calculations are correct.

State of Indiana Form 1043: Agreement to Compensation

Also, a worker’s comp insurance company’s decision to terminate TTD is frequently controversial. They may be taking a harsh stance over just one missed doctor’s appointment, or the injured employee may disagree with the treating doctor’s decision to place the employee at MMI. Even great worker’s comp lawyers like Charles Hewins at Salmon & Hewins Law Firm cannot force insurance companies to re-instate TTD, we know how to preserve the record, gather evidence, and present that evidence to worker’s compensation judges.

If you have any questions about TTD or the situations in which it’s owed, you can always call Salmon & Hewins with questions. The initial consultation is always free.

7505 Eagle Crest Boulevard

7505 Eagle Crest Boulevard